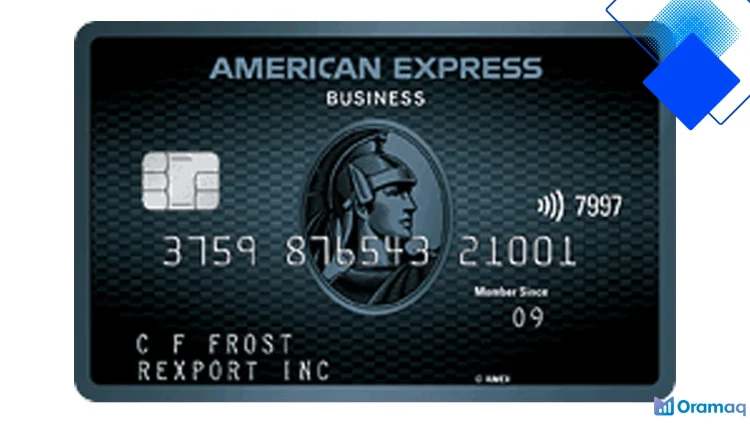

American Express Business Explorer review Australia: top business credit card for points, ATO rewards, lounge access and no-fee employee cards

American Express Business Explorer business credit card delivers big rewards for Aussie small businesses, earning points on every $1, including ATO payments, with lounge access and up to 99 employee cards at no annual fee

Big rewards that boost your bottom line

The American Express Business Explorer is a business credit card built for Aussie small businesses that want to turn everyday spending into valuable points. You earn 2 points per $1 on most eligible purchases and 1 point per $1 on payments to government bodies like the ATO, which makes the card great for managing BAS and tax outgoings.

Points are flexible and can be redeemed via American Express Travel or transferred to partners such as Velocity Frequent Flyer, Singapore Airlines KrisFlyer and Hilton Honors. That steady points flow helps keep travel and supplier costs down while you focus on running your business in Australia.

Control spending with employee cards and tools

One standout is the ability to issue up to 99 employee cards at no additional annual fee, which is rare among business credit cards in Australia. Centralising team expenses onto Amex Business Explorer simplifies bookkeeping, improves spend visibility and accelerates points accumulation across the whole company.

Card controls and reporting tools let you set limits and track purchases in real time, so reconciling cards with your accounting software becomes easier. For sole traders and small teams, this means less admin and more time to grow revenue.

Travel perks, lounge access and insurance

The card includes two complimentary airport lounge passes per year and complimentary travel insurance, which is handy for business owners who fly interstate or overseas. Lounge access makes business travel less stressful, while insurance gives practical cover for delays, baggage and medical incidents.

Because the Amex Business Explorer doubles as a rewards and travel tool, you can use points for flights and hotels and enjoy perks that help your team arrive ready for work. These extras add real value when considering the annual fee after the initial offer period.

Fees, fine print and how to max your benefits

Australian applicants should note the usual promotional first year fee waiver and a subsequent annual fee – commonly around $149 p.a. after the introductory period. Interest on carried balances and fees for late payments can reduce the card’s value, so it pays to pay off balances each month and use the card as a rewards vehicle rather than a loan.

To maximise points, load regular business expenses, supplier invoices and ATO payments onto the card where accepted. Keep an eye on targeted Amex offers and transfer bonuses to squeeze more value from points. If you want a competitive business credit card that marries points with practical tools for Aussie businesses, consider the American Express Business Explorer and compare it with your current card to see the uplift.