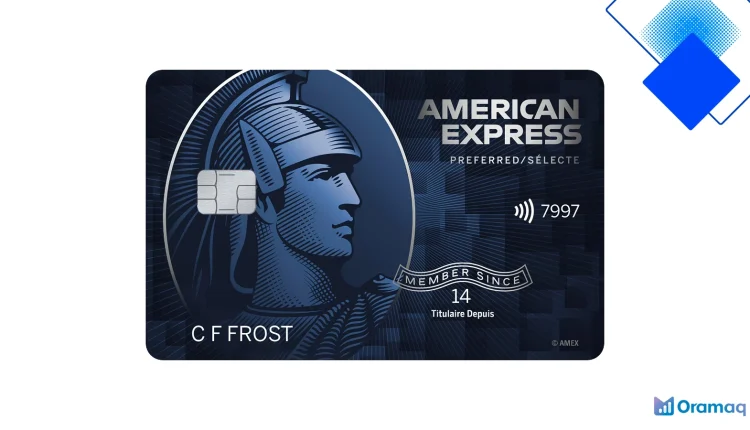

Amex SimplyCash Preferred Review: Make Every Loonie Count with 2% Cashback in Canada

Keep more loonies with Amex SimplyCash Preferred, earn 2% cashback on everyday purchases across Canada, redeem as statement credit and enjoy practical travel and purchase protections

Why Amex SimplyCash Preferred shines for Canadians

The Amex SimplyCash Preferred delivers straight-up value for everyday spending in Canada, earning a clean 2% cashback on eligible purchases. It’s a flat-rate card that removes category tracking — great for folks who want to keep things simple while putting more loonies back in their pocket.

With an annual fee around $99, the math usually works if you put regular monthly bills, groceries and dining on the card. Canadian cardholders appreciate that cashback posts as statement credit, so savings are obvious and immediate.

Perks, protections and practical benefits

American Express bundles travel and purchase protections with the Amex SimplyCash Preferred, including purchase protection and extended warranty that matter when you buy electronics or book a trip. These extras boost the card’s real-world value beyond the 2% cashback.

The welcome offer and optional additional cards for family members help you accelerate rewards. For everyday Canadians in cities from Vancouver to Halifax, those protections and the flexible redemption make the card easy to recommend.

How to maximize your 2% cashback

Use the Amex SimplyCash Preferred for recurring bills, grocery runs, gas and dining to squeeze the most value out of the flat 2% rate. Setting up preauthorized payments for utilities and streaming subscriptions turns routine spending into steady cashback without extra effort.

Add an authorized user for shared household expenses and review monthly statements to spot missed categories; even though it’s flat-rate, tracking helps you move higher-value purchases onto the card. Redeem frequently as statement credits to keep cash flow tidy.

Costs, comparisons and applying in Canada

The $99 annual fee is competitive when balanced against a full-year of 2% cashback on everyday spend; compare that to no-fee cards with lower rates and you’ll see where the SimplyCash Preferred wins for consistent return. It’s particularly strong versus grocery-specific or rotating-category cards.

Applying is straightforward via the American Express Canada website — submit basic ID and income info and many applicants get quick decisions. If you live in Canada and want simple, reliable cashback, the Amex SimplyCash Preferred is a top contender that keeps loonies working for you.