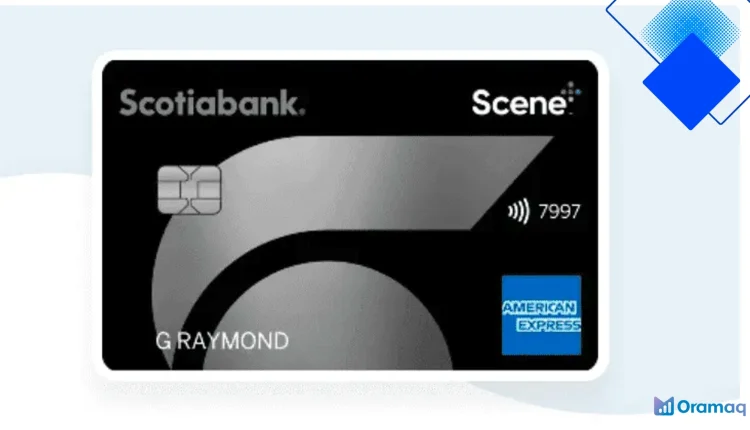

Scotiabank Platinum American Express Canada review, Scotia Rewards points and lounge access

Scotiabank Platinum American Express Canada, a practical breakdown on maximizing Scotia Rewards points, airport lounge access and travel protection to justify the annual fee

Overview of the Scotiabank Platinum American Express

The Scotiabank Platinum American Express is a premium Canadian credit card aimed at travellers and frequent spenders who want rich perks without a bank switch headache. With a competitive annual fee and broad benefits, this Scotiabank Amex card positions itself as a top choice in Canada for those who value travel insurance, concierge service and lounge access.

Cardholders earn Scotia Rewards points on everyday purchases and benefit from American Express’ merchant network. For Canadians in Ontario, BC or Quebec who travel domestically and internationally, the combination of Scotia Rewards points and travel protections often offsets the annual fee when used strategically.

Scotia Rewards points: earning and redeeming

Scotia Rewards points are the core value proposition: earn points on groceries, dining and daily transit, then redeem for flights, hotels or statement credits. Typical earn rates favour categories like dining and entertainment, making the Scotiabank Platinum American Express attractive for regular spenders who want flexibility in redemption.

Redemption is straightforward through Scotiabank’s portal or travel partners, and points transfer options can increase value for travel redemptions. If you prioritise maximizing Scotia Rewards points, track bonus categories and seasonal promotions to stack rewards efficiently.

Travel benefits, lounge access and insurance

Lounge access is a headline perk: the Scotiabank Platinum American Express provides entry to the American Express Global Lounge Collection, which means access to select lounges at Pearson (YYZ) and other major hubs. For frequent flyers, lounge access alone can turn an annual fee into a net gain in comfort and productivity.

Travel insurance covers trip cancellation, interruption, emergency medical and rental car loss or damage, delivering peace of mind for trips across Canada and abroad. Combining Scotia Rewards points redemptions with this insurance protection makes the Scotiabank Amex a practical travel companion for Canadian travellers.

Costs, eligibility and final thoughts

The annual fee, typically around CAD 399, should be weighed against real monthly use: if you redeem Scotia Rewards points for travel and use lounge access regularly, the value quickly adds up. The card requires good to excellent credit, and supplementary cards may carry additional fees.

In summary, the Scotiabank Platinum American Express is a strong fit for Canadians who travel, dine out frequently and want a flexible rewards currency. Apply online if you can commit to leveraging Scotia Rewards points and lounge access; for many residents of Toronto, Vancouver and beyond, this card delivers premium benefits that justify the cost.