Venmo Credit Card Delivers Personalized Cash Back and No Annual Fee

Earn personalized 3%/2%/1% cashback on your top spending, add the virtual card instantly in the Venmo app, and enjoy crypto-friendly rewards with no annual fee

How the Venmo Credit Card works

The Venmo Credit Card is built for people who already live in the Venmo app. Issued by Synchrony, it learns your spending patterns and automatically applies 3%/2%/1% cashback to your purchases each month—3% on your top category, 2% on the second, and 1% on everything else. There’s no annual fee, and you can add a virtual card right away in the Venmo app after approval.

Every transaction posts to your Venmo activity stream so you can track rewards in real time. The card is ideal if you prefer simple, automated rewards over chasing rotating categories or temporary sign-up bonuses. Because the card ties directly to your Venmo profile, splitting bills and paying friends becomes faster when you use your Venmo Credit Card to fund purchases.

Personalized cashback and crypto-friendly rewards

Personalized cashback is the headline: the Venmo Credit Card maximizes your actual spending instead of forcing you into predefined buckets. Whether your biggest spend is groceries, rideshares, or dining out, the card adapts and gives you the highest rate where it matters. That makes it one of the most user-friendly cashback cards with no annual fee for everyday Americans.

Another US-centric perk is crypto flexibility—earn cashback and convert rewards to crypto in the Venmo app without an extra transaction fee (watch for conversion spreads). This is convenient for customers who want to experiment with digital assets while keeping rewards accessible for everyday use or transfers back to their Venmo balance.

Perks, fees, and APR

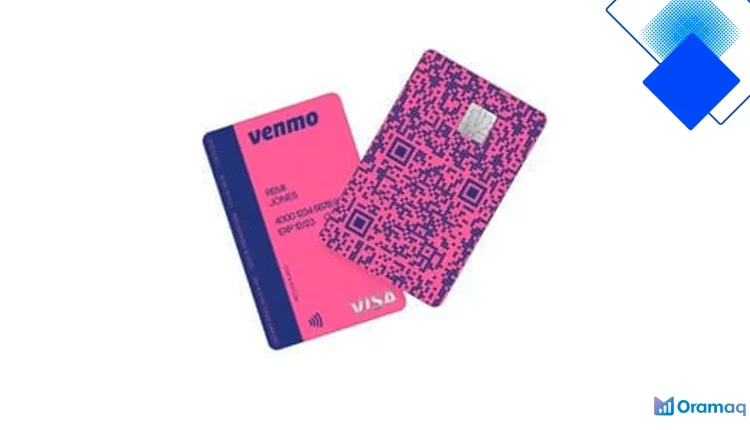

The Venmo Credit Card’s perks include an instant virtual card, a personalized QR code on the physical card for easy money requests, and seamless management in the Venmo app. There are no foreign transaction fees, which is handy for Americans traveling or making purchases from US-based services that bill in dollars.

Costs are straightforward: no annual fee, but your APR will vary based on credit—typical ranges sit in the mid-to-high teens to low twenties. Cash advances and late payments carry standard penalties, so plan to pay on time and in full when possible to avoid interest that can erode your cashback gains.

Should you apply and how to maximize rewards

If you use Venmo frequently and have good to excellent credit, the Venmo Credit Card is an easy pick for steady cashback without extra fuss. Apply in the Venmo app after meeting the 30-day account requirement and, upon approval, add the virtual card to Apple Pay or Google Wallet to start earning immediately.

To squeeze the most out of the card, monitor your top categories in the app, time major purchases when a category spikes, and convert rewards based on your goals—cash back to your balance for daily use or convert to crypto if you want exposure. Ready to simplify rewards? Open the Venmo app and apply to get the virtual card now.