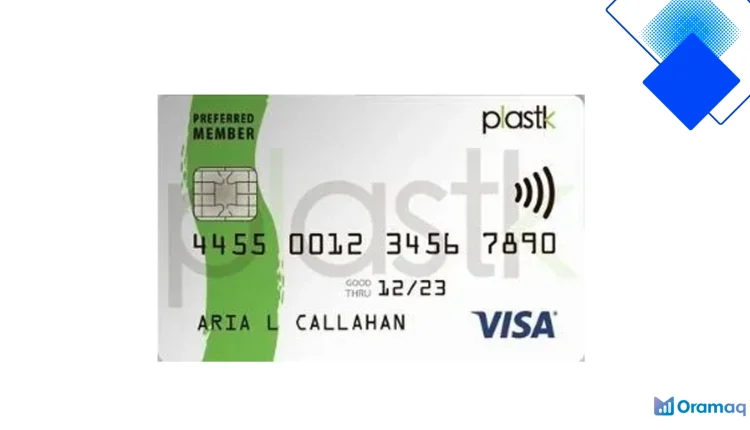

Plastk Secured Visa Review Canada 2025 – Build Your Credit Score and Earn Rewards

Plastk Secured Visa in Canada, a smart low-fee option for Canadians to rebuild credit, boost your score and earn rewards

Why choose the Plastk Secured Visa in Canada

The Plastk Secured Visa card is a practical choice for Canadians who need to rebuild credit or establish a first credit file. With clear reporting to Equifax Canada and TransUnion, the Plastk Secured Visa helps responsible cardholders see real improvements to their credit score over time.

It’s issued in CAD, requires a refundable security deposit that sets your credit limit, and offers no annual fee on many versions—making it one of the lower-cost secured credit options in Canada for people starting out or recovering from past credit issues.

Key features, fees and rewards

Plastk Secured Visa stands out because it combines credit-building features with a rewards program: you earn points on everyday purchases which can be redeemed for statement credits or merchandise. Interest rates and a foreign transaction fee apply, so it’s best used for regular Canadian spending to maximize rewards without extra costs.

Fees are transparent—security deposit in CAD, possible late payment charges, and standard interest on carried balances. Keeping balances low and paying on time avoids interest and late fees, letting the Plastk Secured Visa work exactly as intended: building positive payment history.

How to apply and get the most from your card

Applying for the Plastk Secured Visa is straightforward: Canadian residency, valid ID and a security deposit are the main requirements. The online application typically asks for basic personal and employment details, and approval is usually quick so you can start rebuilding your credit without long waits.

To optimize results, treat the Plastk Secured Visa like a credit-builder: make on-time monthly payments, keep utilisation under 30%, and use the card for recurring, budgeted purchases. Over time you can request an increase by adding to your security deposit or asking for a periodic review.

Practical tips, customer support and next steps

Set up pre-authorized payments to avoid late fees and check your statements monthly to spot any discrepancies. If you travel outside Canada, plan ahead: foreign transaction fees may apply on Plastk Secured Visa purchases, so use local payment options when possible to reduce costs.

Plastk customer support in Canada is familiar with regional needs and can explain deposit returns, rewards redemption, and credit reporting timelines. For many Canadians, the Plastk Secured Visa offers a realistic, cost-effective path to rebuild credit and earn rewards while doing it—start small, be consistent, and monitor Equifax and TransUnion scores to track progress.