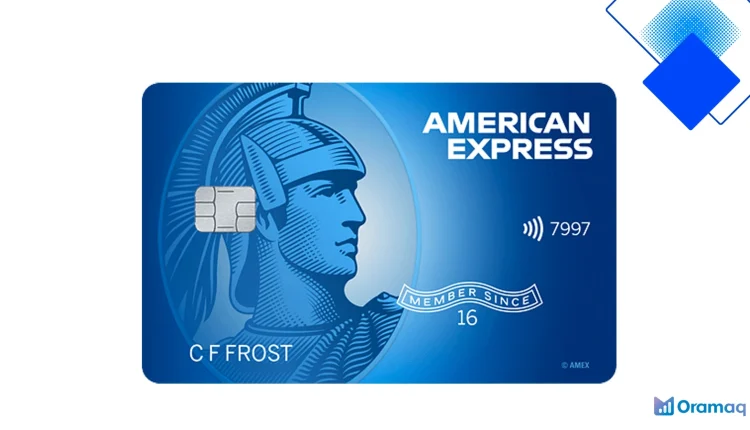

Blue Cash Everyday Card 3% Cash Back on U.S. Groceries Gas and Online Shopping No Annual Fee

Turn everyday purchases into real savings with the Blue Cash Everyday Card, earning 3% back on U.S. groceries, gas and online shopping, all with no annual fee

Smart rewards for everyday U.S. spending

The Blue Cash Everyday Card delivers straightforward cashback where Americans spend most: groceries, gas and online retail. Cardholders earn 3% back in those U.S. categories (on qualifying purchases up to annual caps) and 1% back on other spending, turning routine buys into real savings.

That clear rewards structure makes the card easy to use—no rotating categories to track, no confusing point charts. If you shop at supermarkets, fill up your car at participating gas stations, or buy from U.S. online retailers, the Blue Cash Everyday Card can add up to noticeable rewards over a year.

Fees, intro APR and bonus highlights

One major selling point is the $0 annual fee, which keeps the card low-cost for long-term use. New cardmembers also often see promotional perks like a 0% intro APR on purchases and balance transfers for a limited period, which can help when financing a big purchase or consolidating debt.

Look for limited-time welcome offers too—commonly a statement credit after meeting a minimum spend in the first few months. Always read the fine print: variable APRs apply after any intro period, and some bonus perks have monthly limits or service exclusions.

Who benefits most and how it compares

The Blue Cash Everyday Card is ideal for everyday American households and commuters who prioritize groceries and gas rewards without paying an annual fee. If your grocery bills are consistent and you shop online with U.S. retailers, the 3% categories can outperform many flat-rate cards.

If you prefer simplicity across every purchase, flat-rate cards like the 2% options may be better. For heavy grocery spenders willing to pay a fee, premium sibling cards offer higher supermarket rates. Match card choice to spending: the Blue Cash Everyday Card is a strong no-fee pick for targeted rewards.

Maximize cashback and next steps

To get the most from the Blue Cash Everyday Card, concentrate the categories: put grocery, gas and eligible online purchases on the card and use other cards for benefits like travel protections or flat-rate returns. Track the annual caps on high-rate categories so you know when earnings will drop to the base 1%.

Ready to act? Check pre-qualification tools to see likely approval without a hard credit pull, review current welcome offers, and read terms for category definitions and caps. Applying strategically and aligning the card with your monthly budget makes the Blue Cash Everyday Card a practical way to boost everyday savings.