BMO Preferred Rate Mastercard Review Reveals Canada’s Top Low-Interest Credit Card for Balance Transfers

BMO Preferred Rate Mastercard delivers low interest rates, clear balance transfer offers and real savings for Canadian cardholders

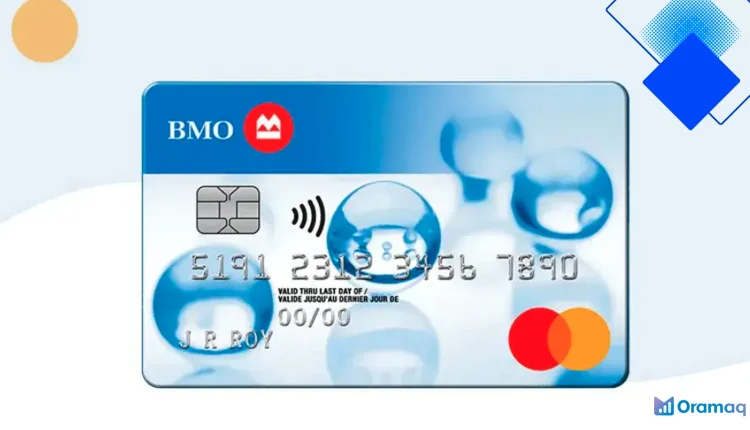

Overview of the BMO Preferred Rate Mastercard

The BMO Preferred Rate Mastercard is a straightforward low-interest credit card built for Canadians who want to pay less on carried balances. It focuses on offering a consistently low APR and clear balance transfer options, making it one of the best low-interest credit card choices in Canada.

Cardholders get practical protections like zero liability on unauthorized transactions, purchase protection and extended warranty, which add tangible value beyond the low rate. For anyone juggling high-interest debt, the BMO Preferred Rate Mastercard puts interest savings front and centre.

Why Canadians pick the BMO Preferred Rate Mastercard

Many people in Canada choose the BMO Preferred Rate Mastercard because it reduces the cost of borrowing without confusing rewards programs or gimmicks. If your goal is to lower monthly interest charges and pay down debt faster, this card’s low APR and balance transfer features are built for that purpose.

Compared with travel or cash-back cards, the BMO Preferred Rate Mastercard trades points for predictable savings — a practical choice for families, students or anyone prioritizing debt reduction. The card’s modest annual fee is often offset by the interest you save each month.

Fees, rates and balance transfer details

Fee transparency is a strong point: the BMO Preferred Rate Mastercard lists a low annual fee and straightforward purchase interest, with promotional balance transfer offers that can cut interest during the intro period. Be mindful of cash advance rates and foreign transaction fees, which still apply if you withdraw cash or spend abroad.

Balance transfers can deliver real savings when moved from higher-rate cards to the BMO Preferred Rate Mastercard, but success depends on paying down the transferred amount within the promotional window. Read the terms so you know the promotional length and any fees tied to balance transfers.

How to apply and smart ways to use it

Applying for the BMO Preferred Rate Mastercard is quick online through BMO’s Canadian site — have your SIN, income info and ID ready for a faster decision. Approval typically requires decent credit, so check your score and consider applying only when your file is in good shape.

To get the most from this low-interest credit card, use it primarily for balance transfers and larger purchases you’ll pay off over time, not for small impulse buys that add to overall debt. Make more than the minimum payments, track promotional deadlines, and combine the card’s protections like purchase coverage to protect your purchases.