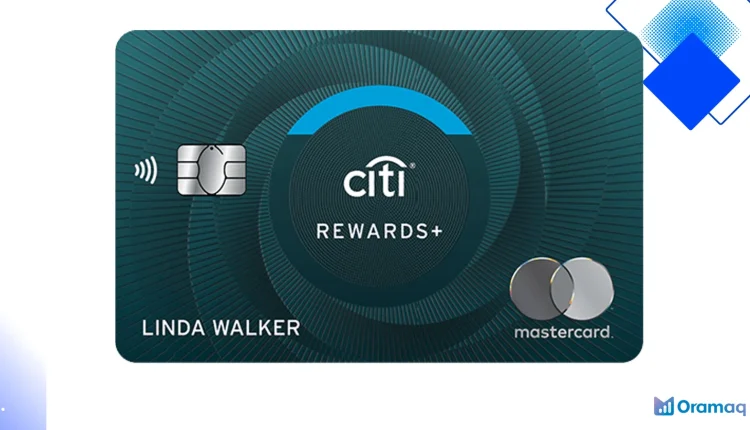

Citi Rewards+ Review | No Annual Fee, $1,500 for 20,000 Bonus, Best for Small Purchases

Citi Rewards+ card packs a 20,000-point sign-up after $1,500 spend, no annual fee, and a round-up perk that boosts rewards on small everyday purchases

Why the Citi Rewards+ card catches attention

The Citi Rewards+ card is a simple, no-annual-fee rewards option aimed at everyday spenders. It stands out with a 20,000-point sign-up bonus after $1,500 in purchases within three months and a unique round-up feature that boosts small purchases to the nearest 10 points.

For shoppers who buy coffee, groceries, and gas frequently, the Citi Rewards+ card can turn tiny transactions into meaningful point totals. The card also offers 2x points at supermarkets and gas stations on the first $6,000 per year, then 1x on everything else.

Costs, APRs, and important limits

There is no annual fee with Citi Rewards+, which helps beginners and light spenders keep value without recurring charges. The card includes a 0% introductory APR on purchases and balance transfers for 15 months, useful if you plan a larger purchase or want to move existing debt.

Be aware of the fees: balance transfer fees are 3% for the first four months, then 5% thereafter, and a 3% foreign transaction fee applies when you use the card abroad. Earn rates cap out and the 10% points-back perk is limited to 100,000 points per year.

How to maximize rewards with Citi Rewards+

To get the most from the Citi Rewards+ card, use it for frequent small purchases thanks to the round-up to 10 points rule. A $3 coffee becomes 10 points instead of 3, and those increments add up fast if you use the card daily for small tickets.

Pair the welcome bonus and the 0% intro APR strategically. Meet the $1,500 spending requirement in three months without overspending, and consider a balance transfer during the intro period to save on interest while you build points.

Who should apply and when to choose another card

The Citi Rewards+ card is best for low- to moderate-spenders who value simplicity and no annual fee. If your spending is heavy on small purchases or you prefer grocery and gas rewards, this card can be a consistent earner and a nice complement to other accounts.

If you travel internationally a lot or want higher ongoing earnings on travel and dining, look for cards with no foreign transaction fees and richer multipliers. Also note you generally need good to excellent credit for approval on the Citi Rewards+ card.