Tangerine Cash Back World Mastercard Tops Canada’s No Annual Fee Cards for Everyday Cash Back

Get up to 2% cash back on groceries, gas and monthly bills with no annual fee and no foreign transaction fees, built for everyday Canadian spending

Everyday cash back built for Canadians

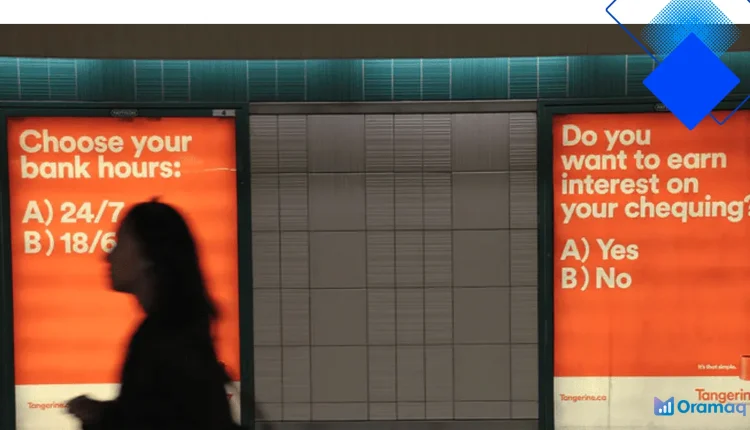

The Tangerine Cash Back World Mastercard is designed for Canadians who want straightforward rewards without the fuss of an annual fee. With up to 2% cash back on the categories you pick, this card turns regular grocery trips, gas stops and monthly bills into tangible savings that appear on your statement or in your Tangerine account.

Living in Canada means juggling household budgets across different provinces, and a reliable no annual fee card like the Tangerine Cash Back World Mastercard helps stretch every dollar. The card’s no foreign transaction fees also makes it handy for cross-border shopping or travel to the United States and beyond.

Features that make a difference

The main selling points are clear: no annual fee, flexible cashback categories and up to 2% cash back in two selected categories. If you link a Tangerine Savings Account, you can add a third category, boosting your rewards for the spending you do most often in Canada.

Beyond cash back, the Tangerine Cash Back World Mastercard includes practical perks like purchase protection and mobile device insurance, giving everyday value without a premium price tag. Together with a competitive interest offering for purchases paid on time, this card competes well among Canada’s best no annual fee credit cards.

How to maximize your cash back

Choose your categories based on real monthly habits: groceries, gas, utilities or recurring subscriptions will typically yield the biggest returns. Rotate categories when your spending changes seasonally, for example switching to travel or dining when you expect different costs in summer.

Combine the card with a Tangerine Savings Account to unlock the third cash back category and set up recurring payments for bills so you earn rewards without extra effort. Pay your balance in full every month to avoid interest that can erase those cash back gains.

Who should apply and how to get started

The Tangerine Cash Back World Mastercard is ideal for Canadians who want simple, reliable cash back on everyday spending without an annual fee. It’s especially useful for families and professionals who prefer money back over complicated points systems and who value no foreign transaction fees for occasional travel.

Applying is straightforward online; make sure you meet basic residency and income requirements and have ID and proof of income ready. Once approved, use the card for the categories you selected, monitor monthly statements and let your cash back grow into meaningful savings.